Just IN

Google Wallet Gets Smarter with Linked Passes: Organization at Your Fingertips

Top trending posts from our top authors which will help users to get some useful information around the world of business

PUBG Mobile Lite: The Best Battle Royale Game for Low-End Devices

PUBG Mobile Lite is a free-to-play battle royale game developed by Tencent Games for low-end … Read More

Three Misleading Myths about Water Features 2023

Water features can be a beautiful and relaxing addition to any outdoor space. However, there … Read More

Visa Interview Tips: How to Prepare and Succeed

Going through a visa interview can be a stressful experience for many people. Whether you … Read More

Variety of other topics related to the world of technology. From the latest news and trends to in-depth product reviews and analysis, we have something for everyone.

Google Wallet Gets Smarter with Linked Passes: Organization at Your Fingertips

Google Wallet Linked Passes: Keeping track of all your digital passes can feel like juggling. … Read More

Apple’s WWDC 2024: Will Generative AI Reshape the iPhone Experience?

Apple’s Worldwide Developers Conference (WWDC 2024) kicks off on June 10th, and anticipation is at … Read More

Variety of other topics related to digital marketing and search engine optimization top notch content from our expert and experienced authors in different sectors.

On-page Optimization: A Comprehensive Guide – 2023

Are you looking to improve your website’s visibility on search engines? On-page optimization can help … Read More

User Generated Content (UGC) Factors to Consider in 2023

User Generated Content (UGC) is a term that is gaining traction in the digital marketing … Read More

Top notch Variety of news content from other topics related to ‘How to things’

Why Can’t I Reply to Specific Messages on Instagram?

Instagram is popular among billions of people all over the world for its interesting features … Read More

How to Get My AI on Snapchat? [Latest – 2023]

AI on Snapchat – the most popular and widely used social media platform that fuels … Read More

How to Turn Off an iPhone 14

There are two ways to turn off an iPhone 14. You can use the physical … Read More

Microsoft Teams is a collaboration platform that is used for communication and file sharing. It has become an essential tool for many businesses to keep employees connected and productive.

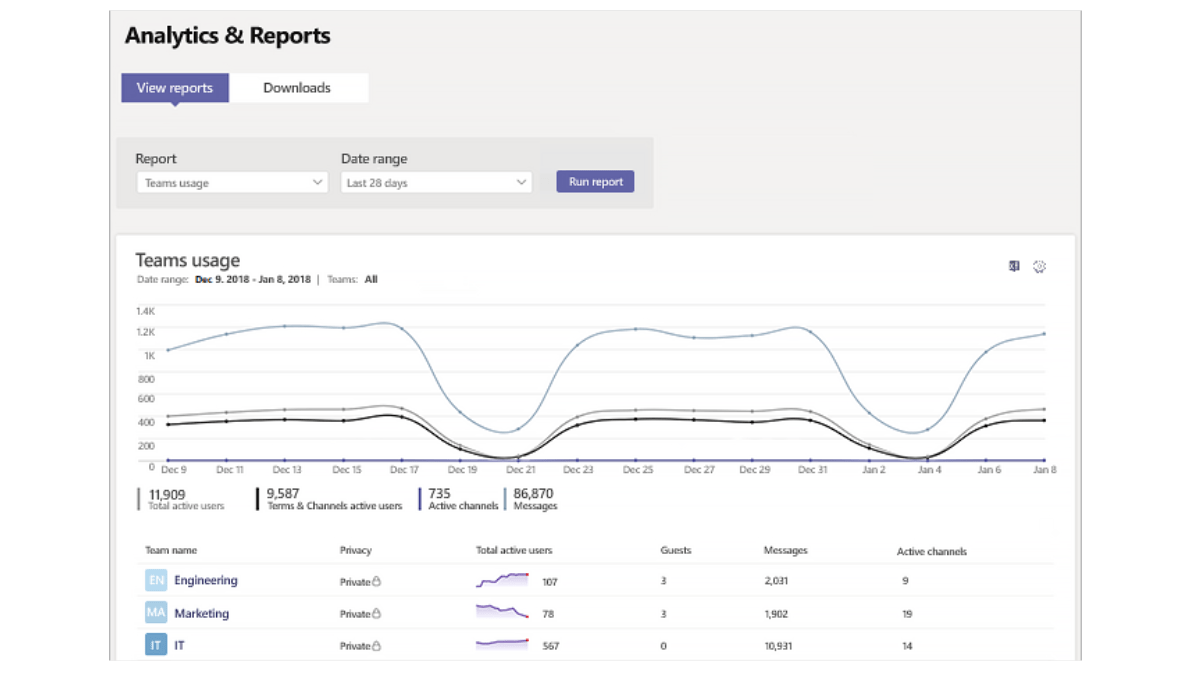

How to Collect Usage Reports from 1 Teams Admin Center

Introduction Usage Reports: Microsoft Teams is a collaboration platform that is used for communication and … Read More

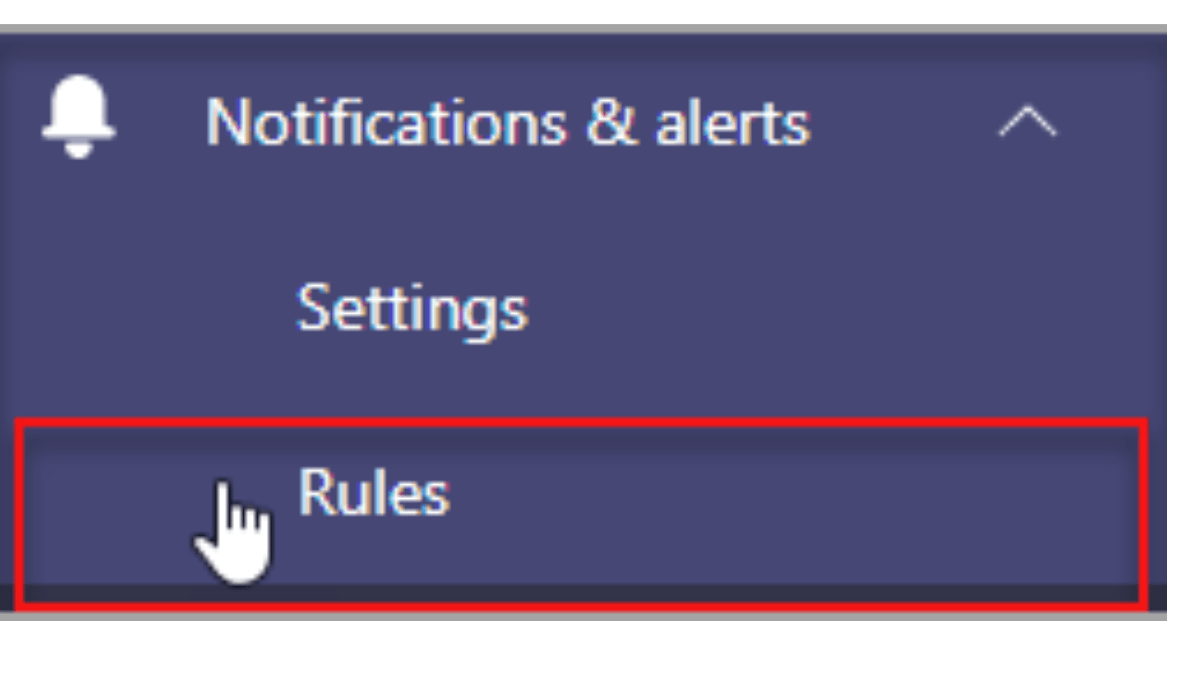

Better way to create 1 Notification and Alert Rules for App Submission and Device State Rule in Teams Admin Center

Introduction Notification and Alert Rules The Teams Admin Center is a comprehensive tool for managing … Read More

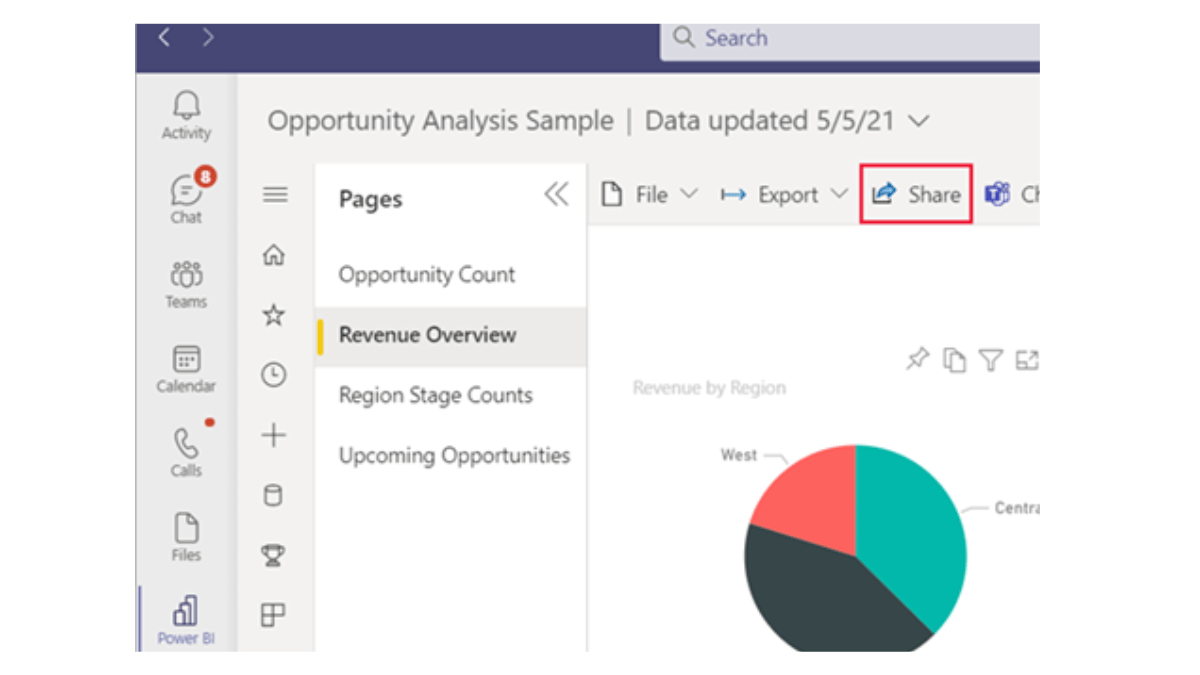

Power BI: How to Export CQD from 1 Teams Admin Center smoothly

Power BI: As businesses and organizations continue to rely on remote work solutions, Microsoft Teams … Read More

Microsoft Exchange Server is a popular email server used by many organizations, Microsoft Exchange Server, providing access to different features and services.

Export Outlook 365 Emails to Gmail Account Directly Using Two Methods

In this guide, we will explain the best solution to export Outlook 365 emails to … Read More

One easy way how to Deploy Exchange Server 2016 on Windows Server 2016

Deploying Exchange Server 2016 on Windows Server 2016 is an essential task for organizations that … Read More

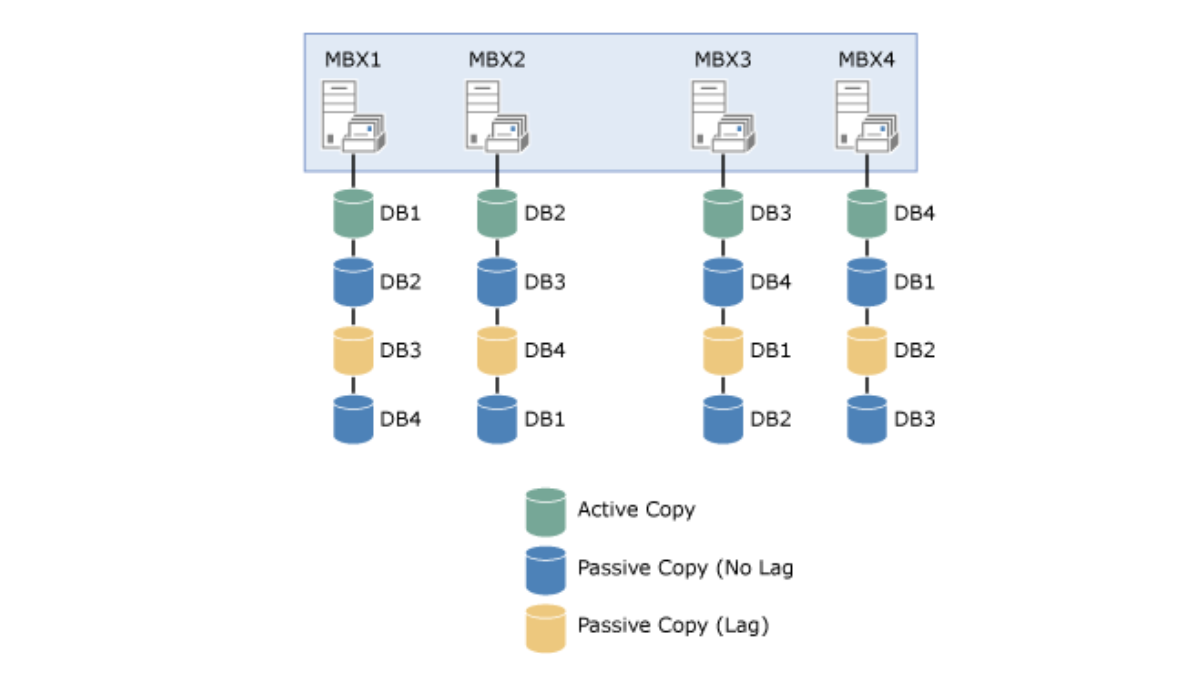

How to Deploy DAG (16) easily in Exchange Server

Deploying a database availability group (DAG) in an Exchange Server environment is a critical task … Read More

Variety of news articles from Microsoft’s top product Skype for Business.

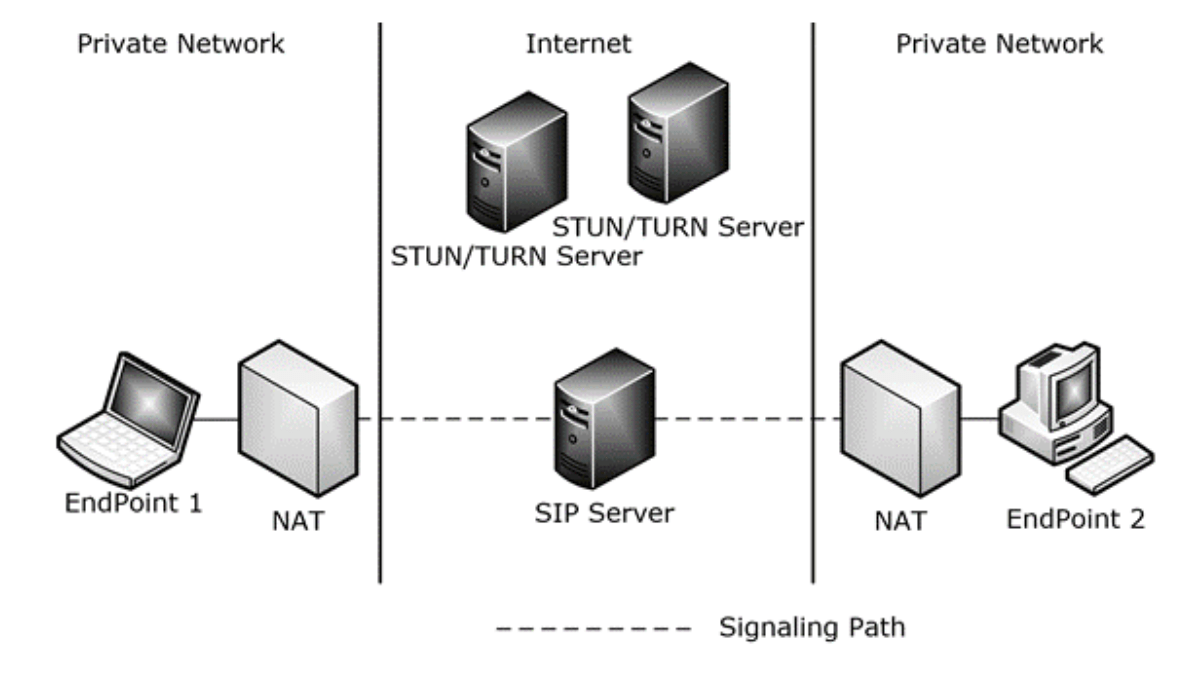

Have you heard about STUN-TURN-ICE in skype for business server environment

Introduction STUN-TURN-ICE are important terms in the world of networking, especially for Skype for Business … Read More

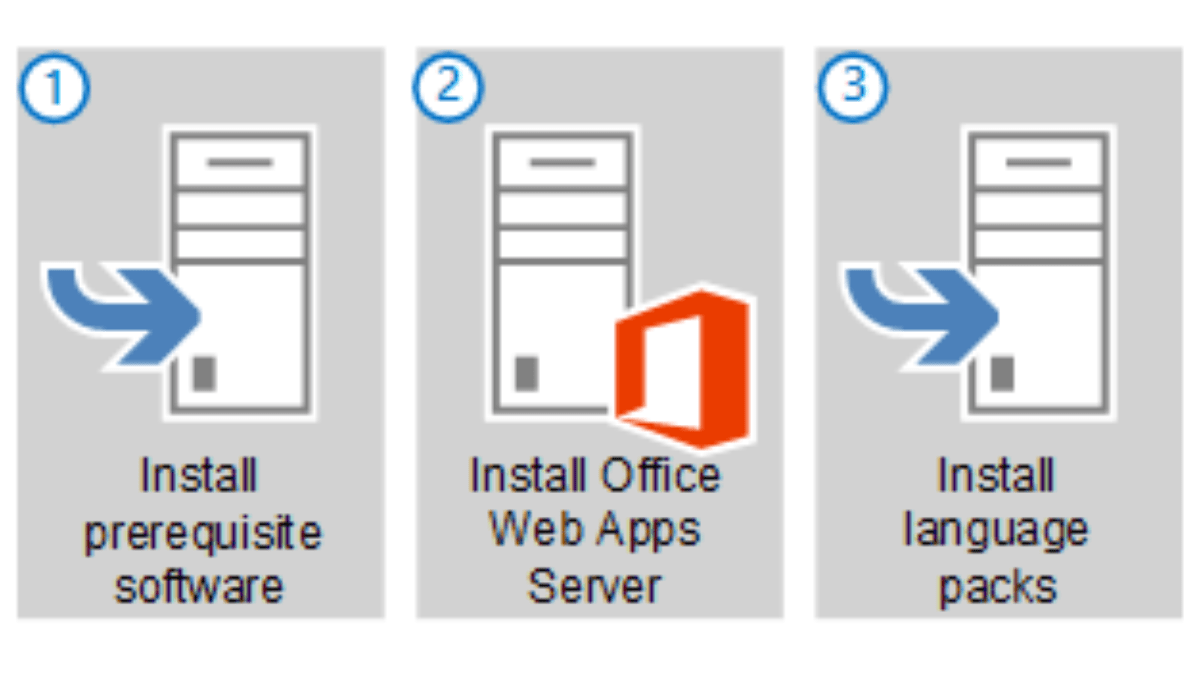

Integration with Office Web Apps Server in Skype for Business Server Environment

Introduction Office Web Apps Server, In today’s business environment, communication plays a critical role. Companies … Read More

Saying Goodbye to Skype for Business Online

Saying Goodbye to Skype for Business Online: As Microsoft announces the retirement of Skype for … Read More